Facts About Hard Money Georgia Revealed

Wiki Article

The Hard Money Georgia Statements

Table of ContentsThe Ultimate Guide To Hard Money GeorgiaThe smart Trick of Hard Money Georgia That Nobody is DiscussingHard Money Georgia Fundamentals ExplainedHard Money Georgia Fundamentals ExplainedA Biased View of Hard Money GeorgiaThe Ultimate Guide To Hard Money Georgia

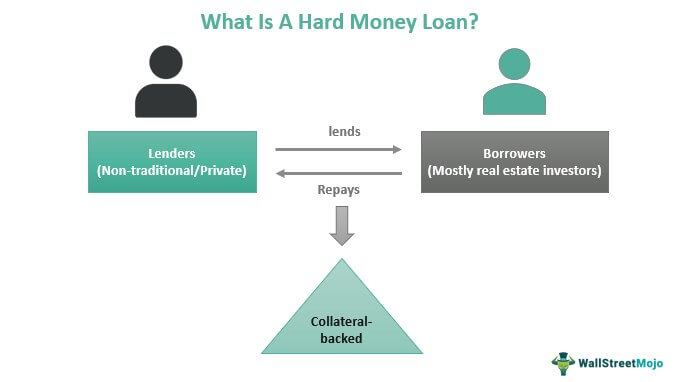

A hard money finance is a customized financing tool that is usually made use of by expert investor. Veteran real estate investors know the ins and outs of hard money fundings, but much less knowledgeable capitalists need to inform themselves on the subject so they can make the finest choice for their particular project.In a lot of cases the approval for the hard cash car loan can happen in just eventually. The difficult money lender is mosting likely to consider the residential property, the amount of deposit or equity the debtor will have in the residential or commercial property, the borrower's experience (if applicable), the exit approach for the residential property and see to it the consumer has some money gets in order to make the month-to-month financing repayments.

Real estate capitalists that haven't formerly used tough cash will certainly be surprised at how swiftly difficult cash financings are funded contrasted to financial institutions. Compare that with 30+ days it considers a financial institution to fund. This rapid financing has conserved countless investor that have been in escrow only to have their original loan provider take out or simply not provide.

Getting The Hard Money Georgia To Work

Their listing of demands enhances each year as well as much of them appear arbitrary. Financial institutions likewise have a list of problems that will increase a red flag as well as stop them from also considering offering to a customer such as recent foreclosures, short sales, finance alterations, and also personal bankruptcies. Negative credit history is one more aspect that will avoid a bank from lending to a debtor.Thankfully for real estate financiers who may presently have a few of these problems on their record, difficult money lending institutions are still able to offer to them. The hard cash lending institutions can lend to consumers with issues as long as the debtor has sufficient deposit or equity (at the very least 25-30%) in the building.

In the situation of a possible customer who intends to acquire a key house with an owner-occupied tough cash car loan through an exclusive home loan loan provider, the customer can at first buy a residential property with hard cash and then function to repair any kind of concerns or wait the essential amount of time to get rid of the problems.

What Does Hard Money Georgia Mean?

Banks are additionally unwilling to give mortgage to customers who are freelance or presently do not have the required 2 years of work background at their current setting. The debtors may be an ideal candidate for the loan in every various other aspect, however these arbitrary requirements protect against banks from extending financing to the customers (hard money georgia).When it comes to the customer without sufficient employment history, they would certainly have the ability to refinance out of the difficult money finance and into a lower expense traditional financing once they obtained the required 2 years at their existing placement. Tough cash lending institutions offer lots of financings that standard loan providers such as financial institutions have no rate of interest in financing.

These jobs entail an investor acquiring a building with a short term car loan to ensure that the investor can quickly make the required repairs and updates and then offer the building. The genuine estate financier only needs a 12 month loan. Financial institutions desire to lend money for the long-term as well as enjoy to make a percentage of rate of interest over an extended period of time.

The Definitive Guide for Hard Money Georgia

The issues can be associated to structure, electrical or pipes and could create the bank to think about the property uninhabitable and also unable to be funded. as well as his explanation are incapable to think about a funding situation that is outside of their strict borrowing criteria. A tough cash lender would have the ability to offer a debtor with a lending to buy a residential property that has problems stopping it from getting a conventional bank lending.

While the rate, reduced requirements and also flexibility of hard money financings makes sure investor have the funding they need to finish their tasks, there are some facets of tough cash lendings that can be thought about less than ideal. Hard money car loan rate of interest are constantly mosting likely to be greater than a traditional bank lending.

Tough cash lending institutions likewise bill a finance source cost which are called points, a portion of the car loan amount. Factors usually vary from 2-4 although there are lending institutions that will charge much higher factors for particular scenarios. Particular areas of the country have several contending tough money lending institutions while various other areas have few.

All about Hard Money Georgia

In huge cities there are typically a lot more tough money lending institutions willing to lend than in farther backwoods. view it Consumers can profit considerably from checking rates at a few different lending institutions prior to devoting to a hard cash loan provider. While not all tough money lending institutions use second home loans or trust fund deeds on residential properties, the ones who do bill a greater rates of interest on 2nds than on 1sts. hard money georgia.

If rate of interest rates drop, the customer has the option of refinancing to the reduced present rates. If the passion prices increase, the borrower is able to keep their lower rates of interest finance and also lender is forced to wait until the funding becomes due. While the loan provider is waiting on the lending to end up being due, their financial investment in the trust fund act is yielding less than what they could obtain for a brand-new trust fund deed financial investment at existing prices. hard money georgia.

Top Guidelines Of Hard Money Georgia

Banks deal with rates of interest unpredictability by offering reduced rates of interest for much shorter terms as well as higher interest prices for longer terms. As an example, a 30 year completely amortized finance is going to have a much greater rate of interest than the 15 straight from the source year completely amortized lending. Some borrowers view down repayments or equity requirements as a detriment that prevents them from getting a lending.Report this wiki page